The penny’s disappearance may simplify currency, but it also reshapes checkout math, sales‑tax rules, and the financial experience of cash‑reliant households.

After more than a century in circulation, the U.S. penny is finally on its way out. The Treasury’s decision to halt new penny production — driven by rising manufacturing costs and declining usefulness — marks a quiet but meaningful shift in how Americans will handle everyday transactions. And while the change may seem symbolic, the financial and retail implications are far from trivial.

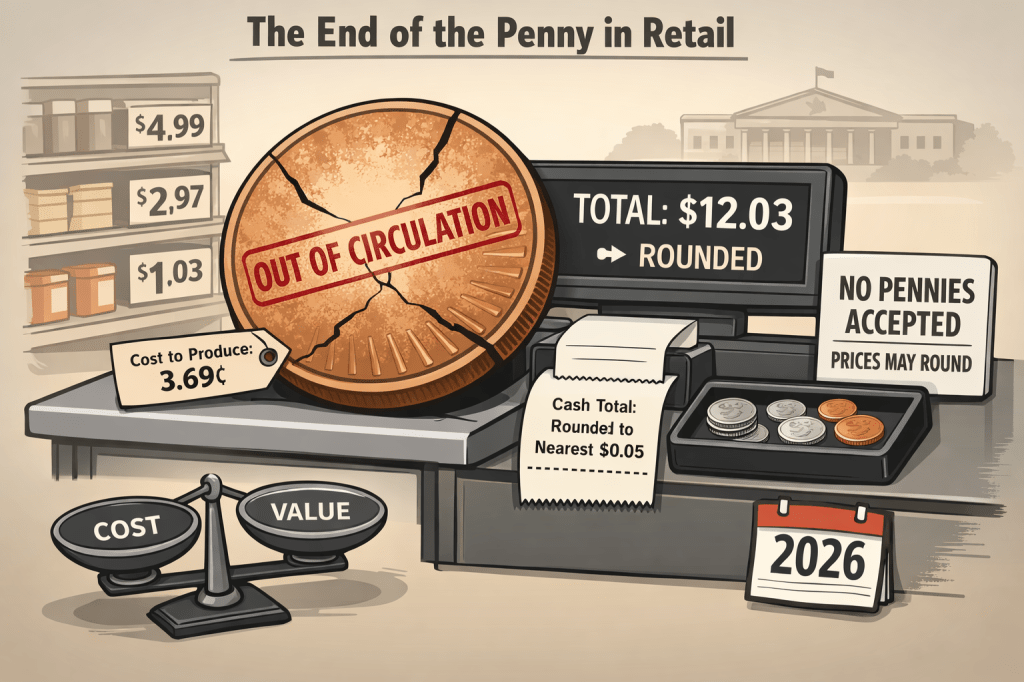

The U.S. Mint reported that producing a single penny cost 3.69 cents in 2024, nearly four times its face value, contributing to an $85.3 million seigniorage loss for the Treasury that year. The economic case for retiring the coin has been building for years, and the U.S. is now following the path of countries like Canada, Australia, and New Zealand, all of which phased out their lowest denominations with minimal disruption.

But the transition will reshape how retailers price goods, how consumers pay, and how states regulate sales tax. The penny’s disappearance is not just a monetary footnote — it’s a structural adjustment.

Rounding Becomes the New Normal

Once pennies are no longer available for circulation, cash transactions will be rounded to the nearest five cents. Digital payments — which now account for the majority of U.S. consumer spending — will remain exact. But for cash users, rounding introduces what economists call a “rounding tax.”

According to an analysis by the Richmond Federal Reserve, rounding could cost U.S. consumers approximately $6 million annually, depending on how retailers adjust their pricing. The impact is small in aggregate but meaningful for low‑income households that rely more heavily on cash.

The same analysis warns that if the nickel were ever eliminated alongside the penny, rounding costs could rise dramatically — up to $56 million per year. For now, only the penny is being retired, but the long‑term trajectory of U.S. coinage remains an open question.

Retailers Face Operational Adjustments

For retailers, the penny’s disappearance is more than a minor accounting change. It affects:

- Point‑of‑sale systems, which must be updated to handle rounding rules

- Cash drawer configurations, which will be reorganized without the lowest denomination

- Pricing strategies, especially for items traditionally priced at $X.99

- Sales tax calculations, which vary widely across states

Some states have already begun issuing guidance on how to handle rounding for sales tax, but many have not. As Avalara notes, fractional tax rates — common in state and local jurisdictions — complicate the transition, and retailers are seeking clarity on how to remain compliant.

The National Conference of State Legislatures (NCSL) emphasizes that states will play a central role in implementing rounding policies, especially because the penny will remain legal tender for non‑cash transactions. In other words, the federal government may retire the coin, but states must manage the practical consequences.

Consumer Trust and Inflation Perception

One of the most persistent concerns is whether rounding will fuel inflation. International experience suggests it won’t: Canada saw no measurable inflationary effect after eliminating its penny in 2013. But perception matters.

If consumers believe rounding always favors retailers — even if it doesn’t — trust can erode. Transparency in how rounding is applied will be essential, especially in cash‑heavy sectors like convenience stores, quick‑service restaurants, and small independent retailers.

A Small Coin With Outsized Symbolism

The penny’s retirement is, in many ways, a reflection of a broader shift toward digital payments and streamlined currency systems. But it also raises questions about how the U.S. adapts to financial modernization — and how well policy keeps pace with consumer behavior.

In the short term, the transition will require retailers, states, and consumers to adjust. In the long term, the disappearance of the penny may be remembered as a small but significant step toward a more efficient, less cash‑dependent economy.

For a coin that costs more to make than it’s worth, its exit is overdue. But its impact will be felt long after it disappears from our pockets.

Leave a comment